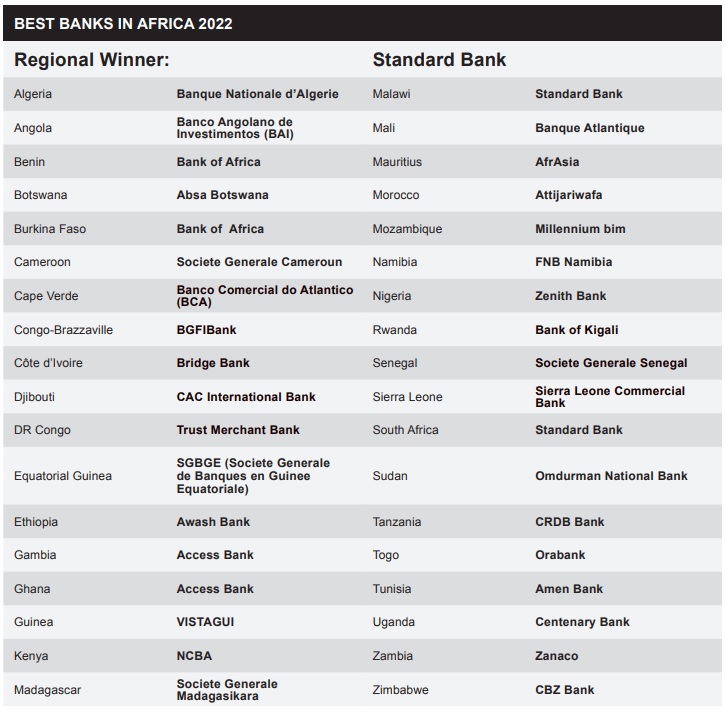

Through an evolving platform business strategy, Standard Bank Group of South Africa has emerged as Best Bank in Africa, according to Global Finance’s World’s Best Banks 2022 Awards, for the second consecutive year. The bank was also named as the best bank in Malawi and South Africa.

“Receiving the highest recognition on the continent from an authoritative institution such as Global Finance is a great honour and an affirmation of the hard work that each of our colleagues across the continent contributes daily,” says Sim Tshabalala, chief executive of Standard Bank Group.

Standard Bank was recognised for its strong business performance, driven by underlying economic recovery in its countries of operation, as well innovation in its client positioning and key transactions driving its expanding platform strategy.

In 2021, the Group outlined its 2025 ambition of being a platform business through a new operating structure, including plans to ‘transform client experience’. By building out from a solid foundation in traditional financial services, the Group seeks to meet its clients on the digital platforms where they are shopping, socialising and doing business.

Winners of the 2022 Awards have been chosen in more than 150 countries and territories across Africa, Asia-Pacific, the Caribbean, Central America, Central & Eastern Europe, Latin America, the Middle East, North America and Western Europe. .

Global Finance’s winning selections were made by the publication’s editors in consultation with corporate financial executives, bankers, banking consultants and analysts. In selecting these top banks, Global Finance considered factors that ranged from the quantitative objective to the informed subjective

“We are aiming to build 10 ‘ecosystems’ adjacent to traditional financial services where we can add more value to our clients’ personal and business lives – for example, by providing home services, by connecting small traders to suppliers, by linking suppliers and consumers of renewable energy, and by helping Africa’s exporters to access international markets.” Tshabalala adds. “As we continue to build these capabilities, we will stay close to the evolving needs of our clients across Africa to ensure that we deliver relevant and impactful solutions that drive inclusive and sustainable growth.”

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.