Access to banking services is crucial for everyday life — whether for depositing and withdrawing money, making payments or receiving transfers.

However, many African asylum-seekers and refugees in Germany struggle to open a bank account due to lack of proper information.

What many do not know is that, by law, every person in Germany, including asylum-seekers, has the right to a Basiskonto (basic bank account). Introduced in 2016 as part of the EU’s Payment Accounts Directive, the Basiskonto is a bank account that all banks are legally required to offer.

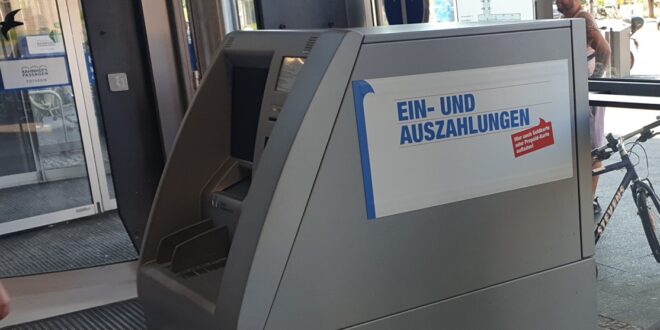

It provides individuals with a basic set of banking services, such as depositing and withdrawing money, making payments, and receiving transfers even if they have a poor credit history or no fixed address.

Here’s what you should know about the basic bank account

What is a Basiskonto?

The Basiskonto is a bank account designed for people who might otherwise struggle to access financial services. It allows individuals, regardless of their residence status, income level or housing situation, to perform essential banking transactions such as:

✔ Deposits and withdrawals

✔ Money transfers

✔ Card payments

✔ Setting up direct debits for rent, phone bills and other services

Unlike regular accounts, the Basiskonto usually does not allow overdrafts, meaning you cannot spend more money than you have in the account.

Who is Eligible?

✔ Refugees and asylum-seekers

✔ People without a fixed residence

✔ Anyone legally residing in Germany, even without permanent status

How to Open a Basiskonto

To apply, visit a bank and request a Basiskonto application. You will typically need:

📌 A valid identification document (passport, residence permit, Duldung etc)

📌 Proof of residence (if available)

📌 A written request for opening a Basiskonto

Banks are legally required to provide this account, but in some cases, they may still reject applications. If a bank refuses to open one for you, they must provide a written explanation. You can appeal this decision through Germany’s financial regulatory authority, BaFin (Federal Financial Supervisory Authority).

Why is it Important?

Having a bank account is not just about convenience—it is essential for financial stability. Without an account, it becomes difficult to receive salaries, pay rent, but online or access important services. A Basiskonto helps you integrate into German society by allowing you to manage your finances more efficiently.

Overcoming Common Challenges

Many refugees hesitate to use bank accounts due to unfamiliarity or distrust in financial institutions. Some withdraw all their money every month and store it in cash, which can be risky. Others may struggle with financial literacy or language barriers. To address these issues:

💡 Seek financial education programs available in your community

💡 Ask for assistance from social workers or refugee support groups. For example, organisations such as Caritas and AWO provide support in opening basic accounts and with financial applications.

💡 Use online banking tools (many have English-language options)

Take Action Today!

If you or someone you know does not yet have a bank account in Germany, ask your nearest bank about the Basiskonto. Knowing your rights and taking advantage of available services can make life in Germany easier and more secure.

For more guidance, reach out to local refugee support organizations or financial advisory centres. A bank account is a step toward financial independence —make sure you claim yours!

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.